Sign In

Credit and Debt JHS

| | 10 Theory slides |

| | 15 Exercises - Grade E - A |

| | Each lesson is meant to take 1-2 classroom sessions |

Catch-Up and Review

Here are a topics that should be understood before getting started with this lesson.

Savings & spending basics:

- What is a personal financial goal?

- How can you make a personal budget?

- What is planned spending vs. necessary spending?

Understanding responsibility and consequences:

- What happens when rules are not followed? (loan repayment fees, penalties, etc.)

Basic percentage and multiplication:

- How will interest increase the total cost of a loan? (e.g., 5 % of $100)

Needs vs. wants:

- Is something worth the cost of paying interest?

- When is borrowing useful or necessary and when is it risky?

What Is a Loan?

A loan is money that you borrow and have to pay back later, usually with extra money added on called interest. When you take out a loan, there are two main parties involved:

- Lender — a person or business (like a bank) that gives the money that is being borrowed

- Borrower — a person that takes a loan and promises to pay it back

Why Do People Take Out Loans?

Sometimes people need money for things that are important but are too expensive to pay for all at once. They might want to buy a car, fix a broken appliance, go to college, or cover any other big expense.

Taking out a loan allows them to get the money they need now and then pay it back, little by little, over time. This way, people can afford big purchases or cover unexpected expenses without having to pay the whole thing right away.Lender or Borrower?

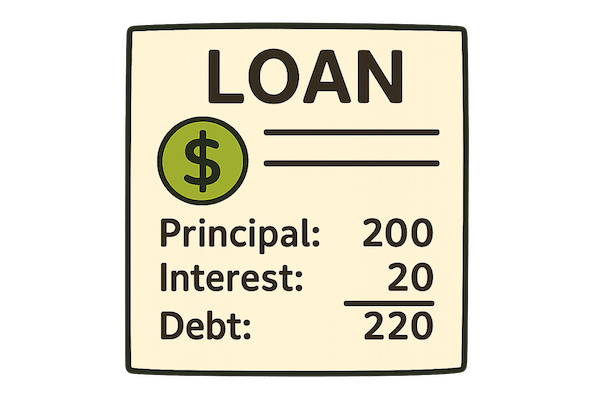

Paying Off a Loan

When you take out a loan, you borrow a certain amount of money which is called the principal of the loan. This is the original amount you borrow, not including anything extra. The most common type of extra money you have to pay is called interest. Interest is like a fee for using someone else's money. Interest is usually a percentage of the principal.

Jalen's New Ride

Jalen wants to buy a used bike for $60.

He doesn't have the money right now, so his older sister says that she will lend it to him but she will also charge him 10 % interest on the loan. He agrees to pay her back in 3 equal payments.

Hint

Solution

$60 + $6 = $66 Jalen will pay back a total of $66 to his sister.

$66/3 = $22 Jalen will pay $22 each time.

$6/3 = $2 For each $22 payment Jalen gives his sister, $2 goes toward the interest.

$22 - $2 = $20 For each $22 payment Jalen gives his sister, $20 goes toward the principal.

The Price of Fun

Ava wants to buy a new video game that costs $30. Her aunt offers to lend her the money but Ava has to pay her back $40 total, in four equal weekly payments.

Hint

Solution

$40 - $30 = $10 Ava is paying $10 in interest.

$10/4=$2.50 Ava will pay her aunt $2.50 each week for four weeks.

Credit Score

How can debt help you build your credit score?

When you borrow money and pay it back on time, you build a good credit score. This shows lenders that you are responsible and can manage your money well. Having a good credit score is like building a good reputation with lenders, which can help you get better loan and credit card deals in the future. Here are some more things that can help or hurt your credit score.

| Actions That Affect Your Credit Score | |

|---|---|

| Help | Hurt |

| Pay bills on time | Miss a payment |

| Keep credit card balances low | Max out credit cards |

| Use credit responsibly | Owe more than you can pay back |

| Keep accounts open for a long time | Frequently open and close credit accounts |

Would It Help, Hurt, or Not Affect Your Credit Score?

Certain actions can boost your credit score, while others can bring it down. Some actions will not change it at all. Look at each situation below and sort it into the most appropriate group.

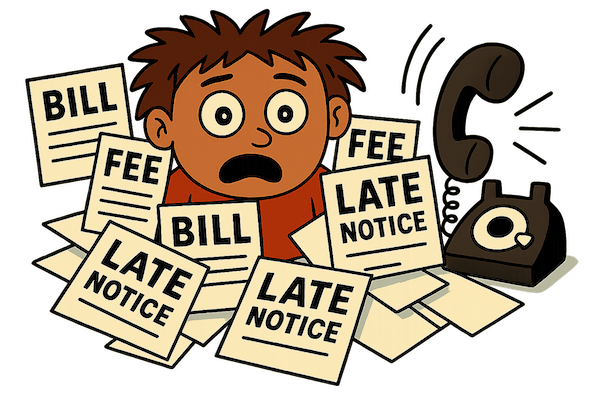

The Hidden Cost of Forgetting to Pay

When you default on a loan, it means you stopped paying it back like you promised. That might not seem like a big deal now, but it can lead to real problems later!

What Happens When You Default

- You still owe the money — and now maybe even more because of late fees.

- Your credit score drops, making it harder to borrow money again in the future.

- The lender might take back what you bought or send collection agencies after you!

How to Prevent Defaulting

There are many ways that you can prevent yourself from defaulting on a loan.

- Only borrow what you know you can pay back.

- Understand interest before you say yes to a loan. Even low interest can add up if you are not careful!

- Make a budget so you know where your money is going.

- Always communicate with the lender if you are struggling — they might be able to help you out.

Lina borrows $200. She agrees to pay $250 back in five equal payments.

Lina agrees to pay back $250 in 5 equal payments. To find the amount of each payment, we divide the total amount to be paid back by the number of payments. $250/5 = $50 Each payment is $50.

The interest percentage can be found by comparing the total interest paid to the original loan amount — the principal. First let's find the total amount of interest that is paid.

Total paid - Principal = Interest paid $250 - $200 = $50

Now we can find the interest percentage by dividing the total interest paid by the principal and multiplying the quotient by 100.

The interest percentage of the loan is 25 %.

What is the biggest concern in this situation?

Your credit score tells lenders if you would be a trustworthy person to loan money to and how likely you are to pay it back on time. Let's consider each of the given options and see if we think it shows that Aiden is a responsible borrower or a risky one.

| Option | Reasoning | Conclusion |

|---|---|---|

| A. He didn't use the full credit limit | This is not a problem. It's actually smart not to use the whole limit. | Not a concern * |

| B. He paid too early | Paying early is good for his credit score. | Not a concern * |

| C. He spent too much of his available credit | Spending too much of his available credit can lower his credit score — especially if he doesn't pay it off right away. | Valid concern ✓ |

| D. He only bought small items | What he purchased does not matter. His credit score is only affected by his ability to pay off the debt. | Not a concern * |

Let's recall what a credit score is and what it tells a lender about you.

Credit Score |- A credit score is a number that shows how likely someone is to pay back a loan. A higher score means that you are considered more trustworthy to lenders.

Option D is the best choice because lenders really only care about how likely you are to repay a loan.

To sort the loan situations from smallest to largest interest percentage, we need to calculate the interest percentage for each scenario. The interest percentage is found by dividing the interest fee by the principal and then converting it to a percentage.

| Scenario | Interest fee | Percentage |

|---|---|---|

| Borrowed $50, repaid $55 | 55 - 50 = 5 | 5/50= 10 % |

| Borrowed $80, repaid $100 | 100 - 80 = 20 | 20/80= 25 % |

| Borrowed $200, repaid $210 | 210 - 200 = 10 | 10/200= 5 % |

Now, we can sort the scenarios based on their interest percentages.

- Borrowed $200, repaid $210 is 5 %

- Borrowed $50, repaid $55 is 10 %

- Borrowed $80, repaid $100 is 25 %

Your credit score tells lenders if you would be a trustworthy person to loan money to and how likely you are to pay it back on time. Let's think about each characters actions and how they would look to a potential lender.

| Scenario | Reasoning | Conclusion |

|---|---|---|

| Anna forgot to pay her loan | Forgetting to pay a loan is called defaultingand it is very bad for your credit score. |

Default |

| Mike paid early | Paying early shows that you are not only a responsible borrower but that you are going above and beyond to show that you will not fall behind on your loan obligations. | Improved credit score |

| Jade uses more than 90 % of his credit limit each month | Using too much of your available credit on a regular basis makes lenders nervous — the more you owe, the harder it is to pay off the loan. | Risky borrower |

| Carlos always pays more than the minimum amount due | Paying more than the minimum shows that you are making an effort to get out of debt faster than the agreed upon terms of the loan. | Responsible borrower |