{{ article.displayTitle }}

| | {{ 'ml-lesson-number-slides' | message : article.intro.bblockCount }} |

| | {{ 'ml-lesson-number-exercises' | message : article.intro.exerciseCount }} |

| | {{ 'ml-lesson-time-estimation' | message }} |

Catch-Up and Review

Here are a few recommended readings before getting started with this lesson.

Budgeting fundamentals:

Basic interest concept:

- Understanding that money can grow over time

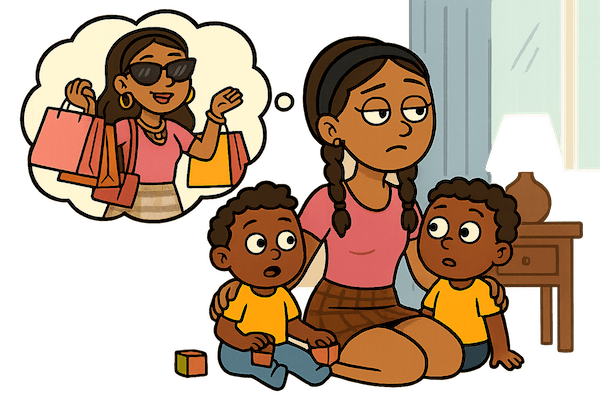

Delayed gratification:

- Understanding long-term vs short-term reward thinking

Basic spreadsheet knowledge: (optional)

- If you plan to use budgeting software

SMART Goals

SMART goals help you stay on track by making your goals clear and easy to follow. They help you know exactly what you want to do and how to get there.

Check the applet below to see what SMART stands for and how each letter can help you set a savings goal.

Goal Sorting: SMART or Not?

Determine whether the goals are SMART or not. Remember, a SMART goal is Specific, Measurable, Achievable, Relevant, and Time-bound. Assess each goal and move it to the correct box!

Get SMART!

Let's look at each of the goals that we determined were not SMART and rewrite them so that they are!

| I want to save some money. |

| I'll buy a new phone sometime this year. |

| I will stop spending so much money. |

Hint

Solution

- How much do we want to save?

- Do we have something specific we want to buy?

- When do we want to have the savings goal met?

- How will we achieve our goal?

With those questions in mind, we can see that the better version of this goal is option B — I will save $10 a week for 10 weeks to buy a skateboard.

| Given | Improved |

|---|---|

| I will delete all shopping apps. | I will cancel my subscription-based apps so that I can save $35 per month and have an extra $210 after 6 months for holiday shopping. |

| I will stop going to the mall. | In order to buy a new $120 pair of sneakers within the next 2 months, I will stop going to the movies at the mall on Fridays where I spend around $20 each time. |

| I won't buy anything this month. | I will save my entire $50 allowance this month so that I can buy $100 concert tickets next month. |

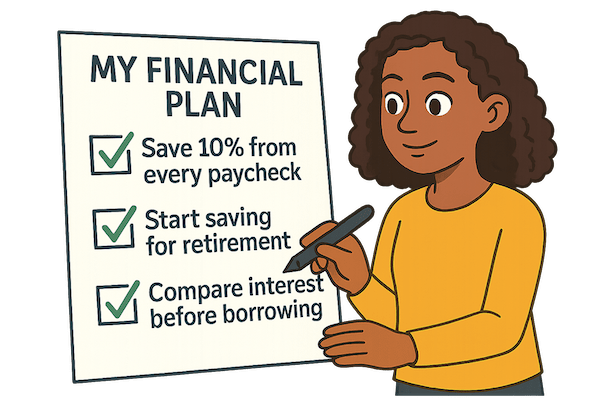

Personal Financial Plan

Financial Record Keeping

Planning and Record Keeping

Effective planning and record-keeping require the right tools and methods. Let's explore some essential ones to help you get started.

Tools and Methods for Creating a Personal Financial Plan

Tools and Methods for Financial Record Keeping

Jordan’s Graduation Goal

Jordan wants to save money for graduation week. He plans to go on a trip that will cost $600. He earns $150 every two weeks from his part-time job. He spends about $50 per paycheck on entertainment and $20 on snacks. He wants to save enough in 4 months.

Hint

Solution

| Option | Logic | Conclusion |

|---|---|---|

| It prevents him from spending money on anything fun. | Tracking spending shows where money goes, but it doesn't stop spending on wants. | Incorrect. Tracking helps adjust choices, not block them. × |

| It helps him get more hours at work. | Tracking spending doesn't affect how much he earns. | Incorrect. This has nothing to do with budgeting. × |

| It guarantees he will save $600. | Tracking helps control spending, but doesn't guarantee savings — he still has to make decisions. | Incorrect. Tracking is helpful, but not a guarantee. × |

| It shows exactly where his money is going so he can adjust his spending. | By logging spending, Jordan can see patterns and decide where to cut back. | Correct. This is the main benefit of a spending log. ✓ |

The main benefit of tracking spending is to understand where money is being spent, which allows for better financial adjustments.

- Set a specific savings goal

Next, you can't adjust your spending unless you know what you are spending your money on. Jordan should track his habits and then adjust his spending according to his goal.

- Set a specific savings goal

- Track current spending habits

- Adjust spending to meet the goal

- He wants to save $600.

- He spends $50 on entertainment.

- He earns $150 every two weeks.

- He hasn't clearly planned how much he will save per paycheck.

Of these, three of them are specific facts about the plan. He knows when his trip is and how much it costs. He knows what his income and expenses are. Also, based on his income, this trip is an achievable goal. What Jordan's plan lacks is clarity on how much he will save per paycheck, which makes it not fully SMART.

Marissa's Monthly Spending Check-Up

Marissa earns $400 a month from babysitting.

She has the following expenses:

- $100 for school lunches

- $60 on phone bill

- $80 on makeup and accessories

- $40 on savings

- $30 on streaming services

- $90 on going out with friends

Hint

Solution

| Option | Reasoning | Conclusion |

|---|---|---|

| She has a lot of wants in her spending. | It shows spending habits, not planning. | Incorrect, doesn't show financial planning. × |

| She uses all her money each month. | Marissa does not use all her money — she saves some. | Incorrect, doesn't show financial planning. × |

| She spends money on going out with friends. | That's part of her wants, not part of a financial plan. | Incorrect, doesn't show financial planning. × |

| She has included a category for savings. | Marissa already puts $40 per month into savings. That shows she's not spending everything she earns. It also means she's prepared for future needs or goals. | Correct, shows financial planning. ✓ |

- Spending tracker: A log where you write down everything you buy so you can see where your money is going

- Budget worksheet: A simple table that helps you list your income and expenses. You can use it to plan where your money will go each week or month.

- Savings goal chart: A visual tool (like a thermometer or progress bar) that shows how close you are to reaching a goal.

Why would she use all of these tools at the same time?

Marissa uses the spending tracker because seeing where her money is going helps her spot areas where she spends too much. Her budget worksheet helps her decide ahead of time how much money she wants to put toward needs, wants, and savings. This helps her prepare instead of react. The savings goal chart allows her to watch her goal being met which makes it easier to stick to her plan.

- Earn more income

- Spend less money

However, before Marissa randomly cuts expenses or chooses a random savings amount, it's smart to first check where her money is going now. This is why the correct option is to Review her past spending and find areas to reduce.

Let's think about why the other options do not work.

-

Set a random savings amount and hope it works

: That's guessing, not planning. -

Delete all streaming services immediately

: This might help her save money, but it's extreme and not the best first step. Reviewing spending helps her make smart cuts, not just quick ones. -

Ask her friends to lend her money

: That doesn't solve the real issue of her spending habits.

If Marissa looks back over last month's spending, she will hopefully notice areas where it makes the most sense to her to make cuts.

Remember, you are the only person who can truly decide if something can be cut from your own budget.

When & How to Reevaluate Your Spending and Saving

When to Check In

- At the end of every month

- Anytime your income changes (like getting a raise or losing hours)

- If you're not reaching your savings goal

- When you have a new expense (like a phone bill or subscription)

- Before big life events (graduation, moving out, buying something big)

How to Do It

- Compare your budget to what you actually spent

- Did you stick to your plan?

- Look at your savings progress

- Are you getting closer to your goal?

- Check for spending habits you can adjust

- Spending too much on snacks? Subscriptions you don’t use?

- Update your SMART goals if your situation changes

- Use a tracker, journal, or app to stay organized

Why It Matters

Reevaluating your plan helps you stay in control of your money and make smart choices, even when things change.